Summer 2021

June 29, 2021

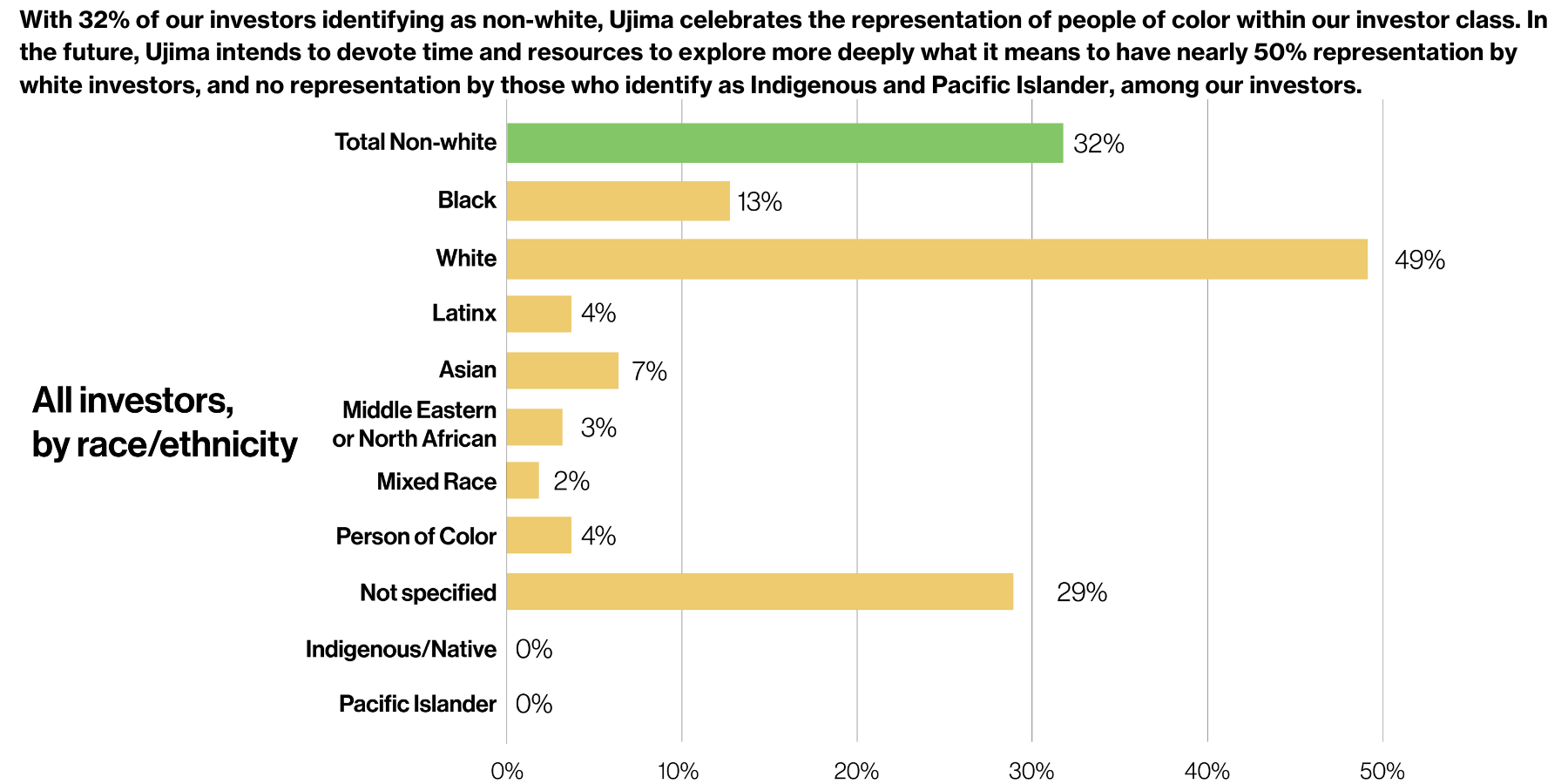

“Total Non-white”. This bar includes all investors who identified as a race/ethnicity other than “White.”

“Not specified”. Overall, nearly one-third of investors chose not to specify their racial/ethnic identity when they invested with us. Currently non-white investors comprise 33% of the group, compared to 49% of white investors. If unspecified investors were in reality people of color, the total range of people of color represented among our investors could be anywhere from 33% to 62%.

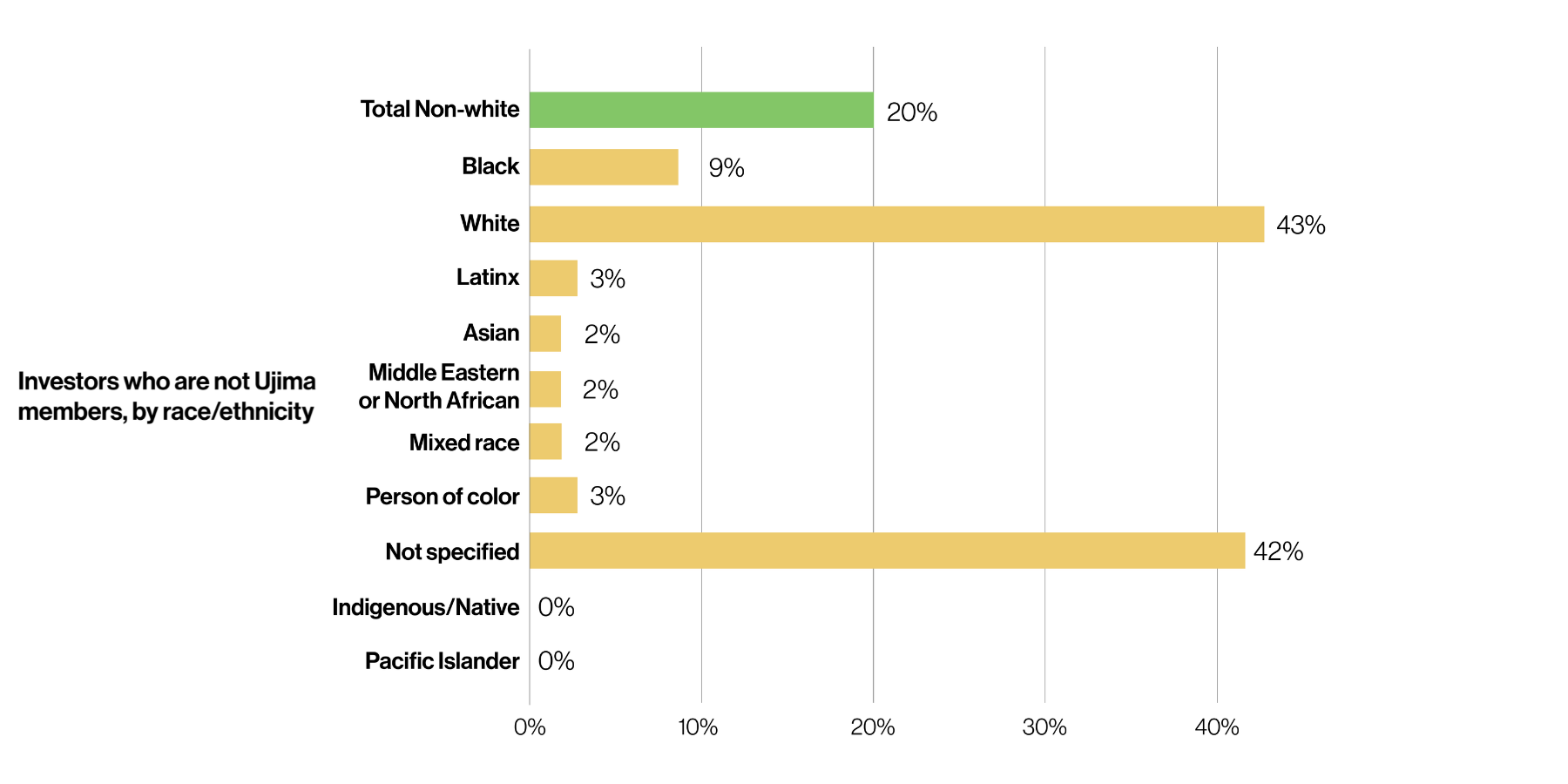

Many of our investors—almost 40%—also participate in the ecosystem as Ujima members. This means they attend Ujima Wednesdays, participate in member teams, and—for Boston residents—vote on investments.

Note: Since Ujima members must be individuals, institutions that invest in Ujima, such as foundations or financial institutions, are not counted as members.

Note: Since Ujima members must be individuals, institutions that invest in Ujima, such as foundations or financial institutions, are not counted as members.

-

Startup loans are made to pre-revenue businesses or businesses that have no history of sales.

-

Microfinance loans are made to businesses that have history of sales but may not be profitable.

-

Small business loans are made to businesses with at least 2 years of financial history.

-

Growth loans are given to businesses with at least 2 years of financial history and a record of being profitable.

Ujima knows that community needs extend beyond small businesses, and also intends to invest in other community-identified needs through these two vehicles:

-

Major initiatives are investments in major projects and infrastructure such as community-owned internet or alternative energy.

- Real estate investments are partnership deals, rehab, and/or acquisition real estate projects with experienced value-aligned investors.

Note: These industry categories are based on the North American Industry Classification System (NAICS) codes, which is a classification of business establishments and types used by the United States government. Above we have listed the top 21 industries in the NAICS system.

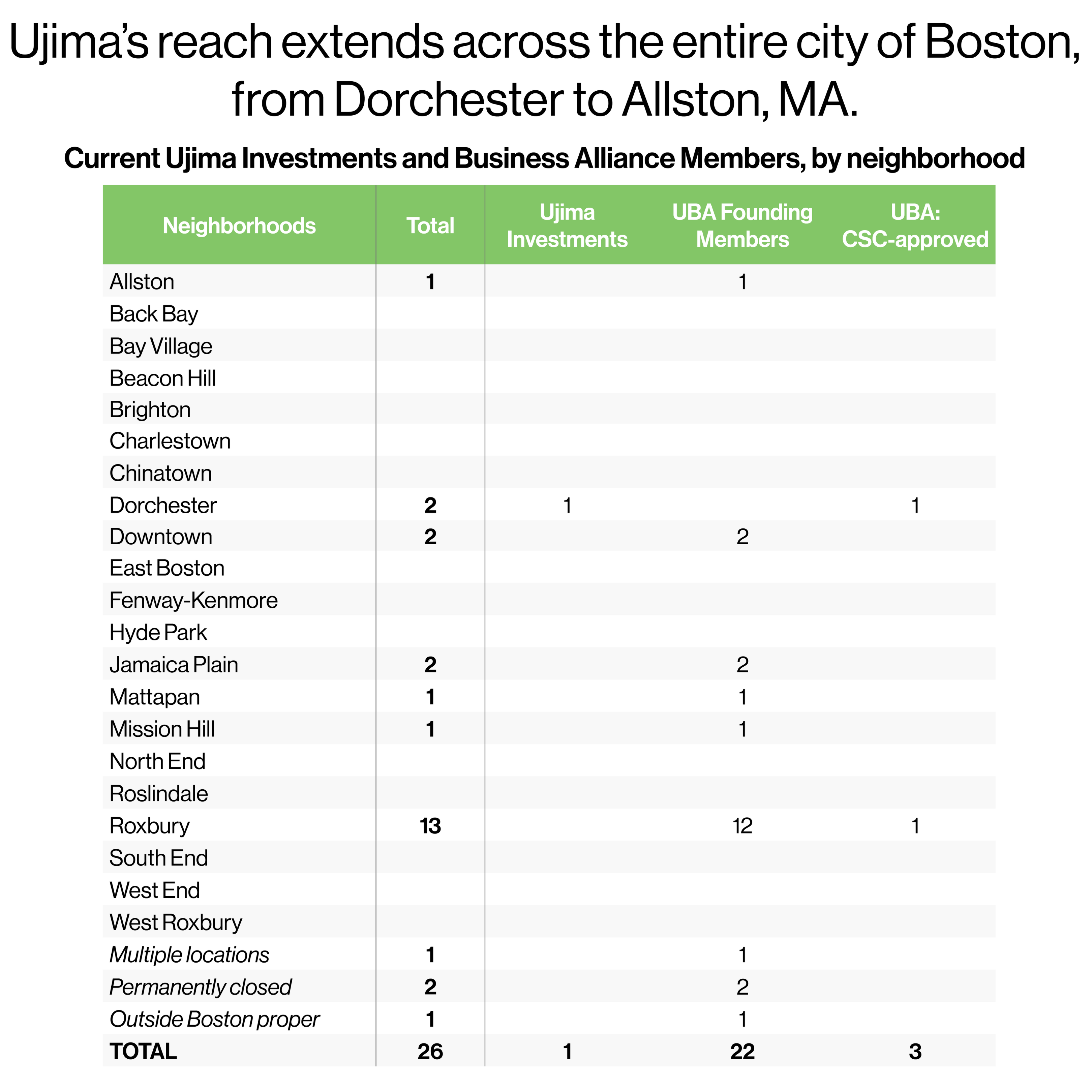

Note: There are 26 founding members of Ujima Business Alliance (UBA). These businesses joined the UBA based on prior relationships with the Ujima community and information that came out of our Neighborhood Assemblies. These members worked with Ujima to co-develop criteria for future membership.

Note: There are 26 founding members of Ujima Business Alliance (UBA). These businesses joined the UBA based on prior relationships with the Ujima community and information that came out of our Neighborhood Assemblies. These members worked with Ujima to co-develop criteria for future membership.In 2019, Ujima’s governing body voted to adopt 36 Good Business Standards that all future members of the UBA must adhere to in order to be part of this community. With the guidance of our 5-member Community Standards Committee, founding members can re-apply to join the Ujima Business Alliance based on the new standards.

So far, 3 of our founding UBA members—CERO Cooperative, Dorchester Food Coop, and Fresh Food Generation—have applied and been approved to join the UBA. In the chart and table, these 3 businesses are referred to as “Founding UBA members approved by the Community Standards Committee” or “CSC-approved.”

As with the table above, we classified our UBA members based on the North American Industry Classification System (NAICS) codes.

The Ujima Fund Balance Sheet is relatively strong with a healthy net balance.

Other current assets hold a portion of undeployed cash which are monies not yet committed to a business investment. In 2019, Ujima members approved 10 financial institutions where the Ujima Fund can place its undeployed cash. In 2020, the Ujima Fund Management team invested 100k in Cooperative Fund of New England (CFNE), an approved financial institution, for a one year term at two percent. In 2021, the Ujima Fund reinvested that same capital back into CFNE for another year.

Note: This balance sheet is a Ujima Fund Management Team prepared statement and not an independently audited financial statement.