Summer 2025

August 26, 2025

About the Ujima Fund’s Investments

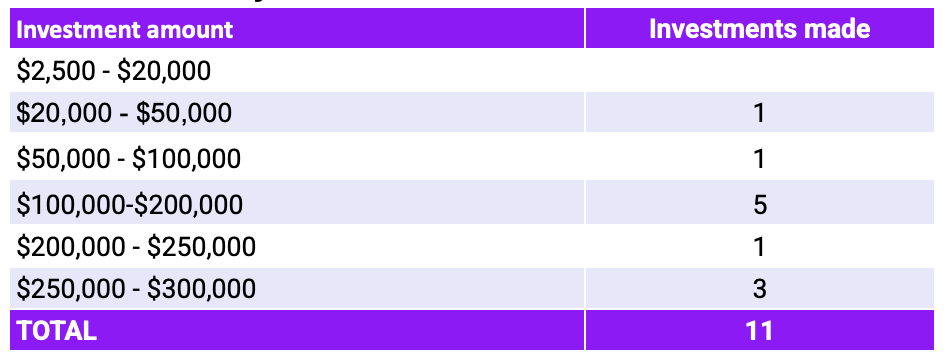

Total Investments

Investments by Amount

Investments by Type

![]()

Note: Ujima matches loan products to align with a business’s stage of growth and dollar amount needed.

- Startup loans are made to pre-revenue businesses or businesses that have no history of sales.

- Microfinance loans are made to businesses that have history of sales but may not be profitable.

- Small business loans are made to businesses with at least 2 years of financial history.

- Growth loans are given to businesses with at least 2 years of financial history and a record of being profitable.

Ujima knows that community needs extend beyond small businesses, and also intends to invest in other community-identified needs through these two vehicles:

- Major initiatives are investments in major projects and infrastructure such as community-owned internet or alternative energy.

- Real estate investments are partnership deals, rehab, and/or acquisition real estate projects with experienced value-aligned investors.

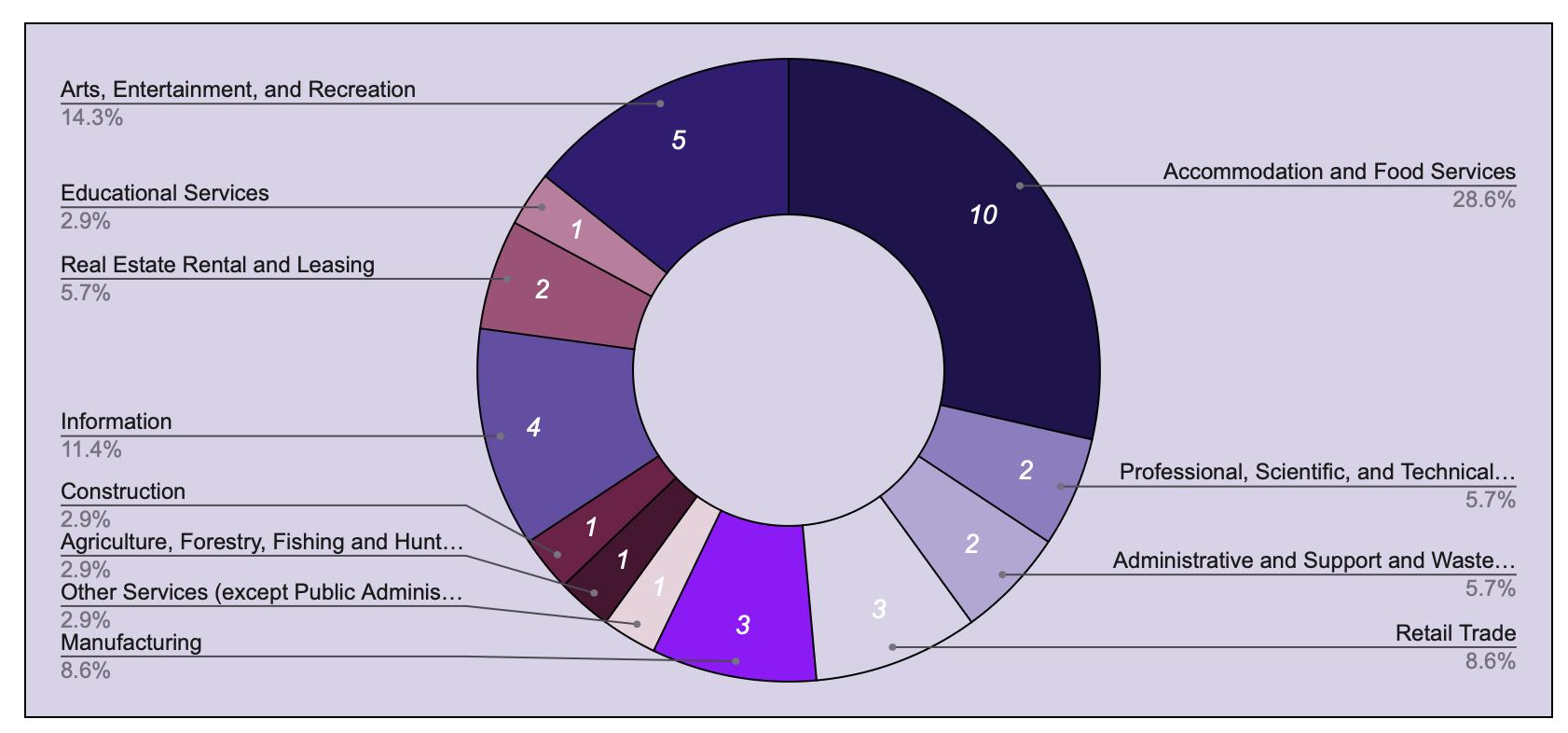

Investments by Industry

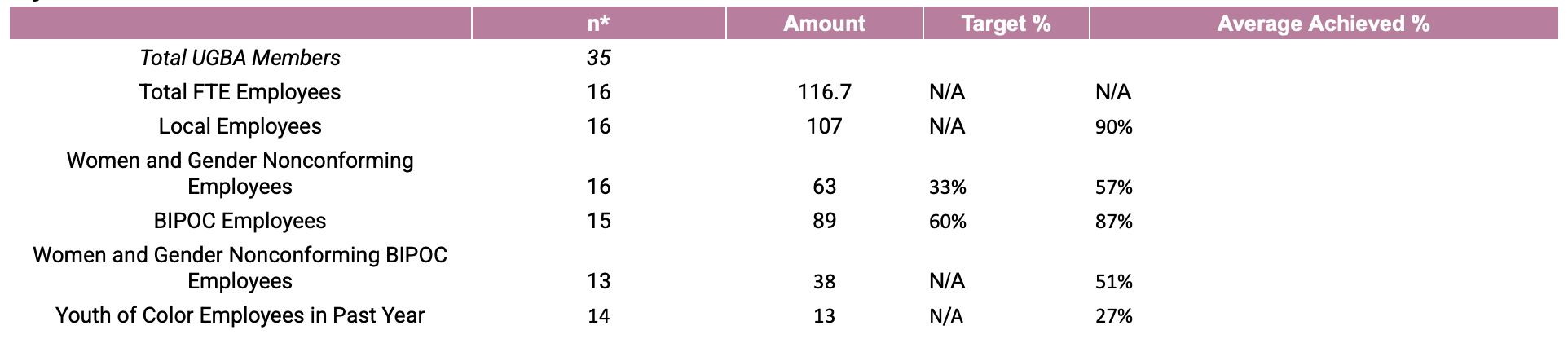

About the Ujima Good Business Alliance

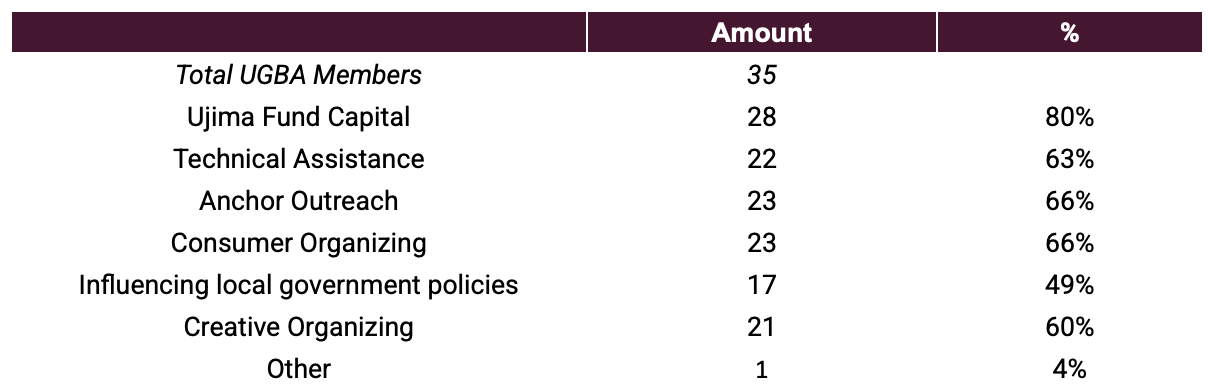

UGBA x Investments x Community Needs

UGBA x Investments x Neighborhood

Ujima Good Business Alliance Member Profiles:

Current Support Needs

Customers & Vendors

UGBA Members by Sector

UGBA Member Certifications