Summer

June 30, 2022

About the Ujima Fund’s Investments

Total Investments

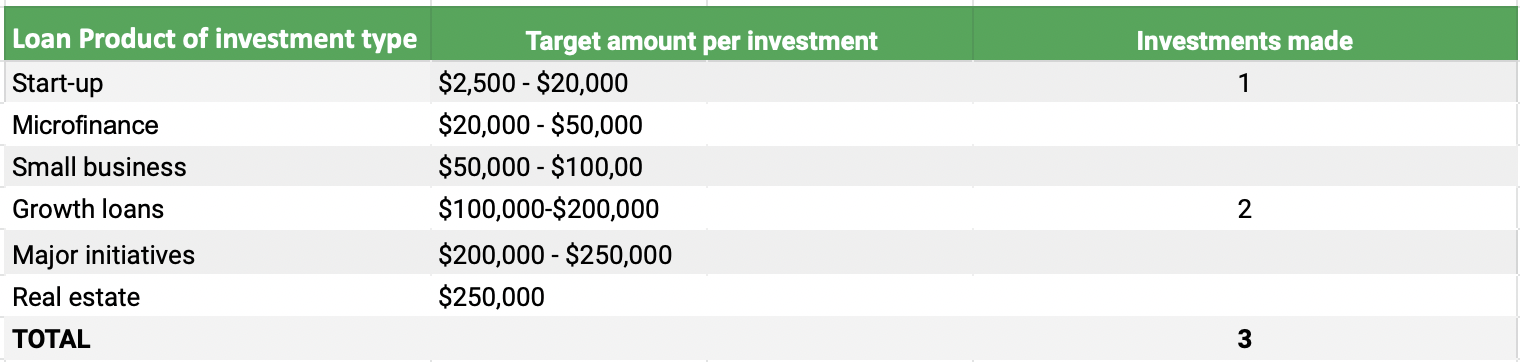

Investments by Type

Note: Ujima matches loan products to align with a business’s stage of growth and dollar amount needed.

- Startup loans are made to pre-revenue businesses or businesses that have no history of sales.

- Microfinance loans are made to businesses that have history of sales but may not be profitable.

- Small business loans are made to businesses with at least 2 years of financial history.

- Growth loans are given to businesses with at least 2 years of financial history and a record of being profitable.

Ujima knows that community needs extend beyond small businesses, and also intends to invest in other community-identified needs through these two vehicles:

- Major initiatives are investments in major projects and infrastructure such as community-owned internet or alternative energy.

- Real estate investments are partnership deals, rehab, and/or acquisition real estate projects with experienced value-aligned investors.

Investments by Industry

Note: These industry categories are based on the North American Industry Classification System (NAICS) codes, which is a classification of business establishments and types used by the United States government. Above we have listed the top 21 industries in the NAICS system.

About the Ujima Good Business Alliance

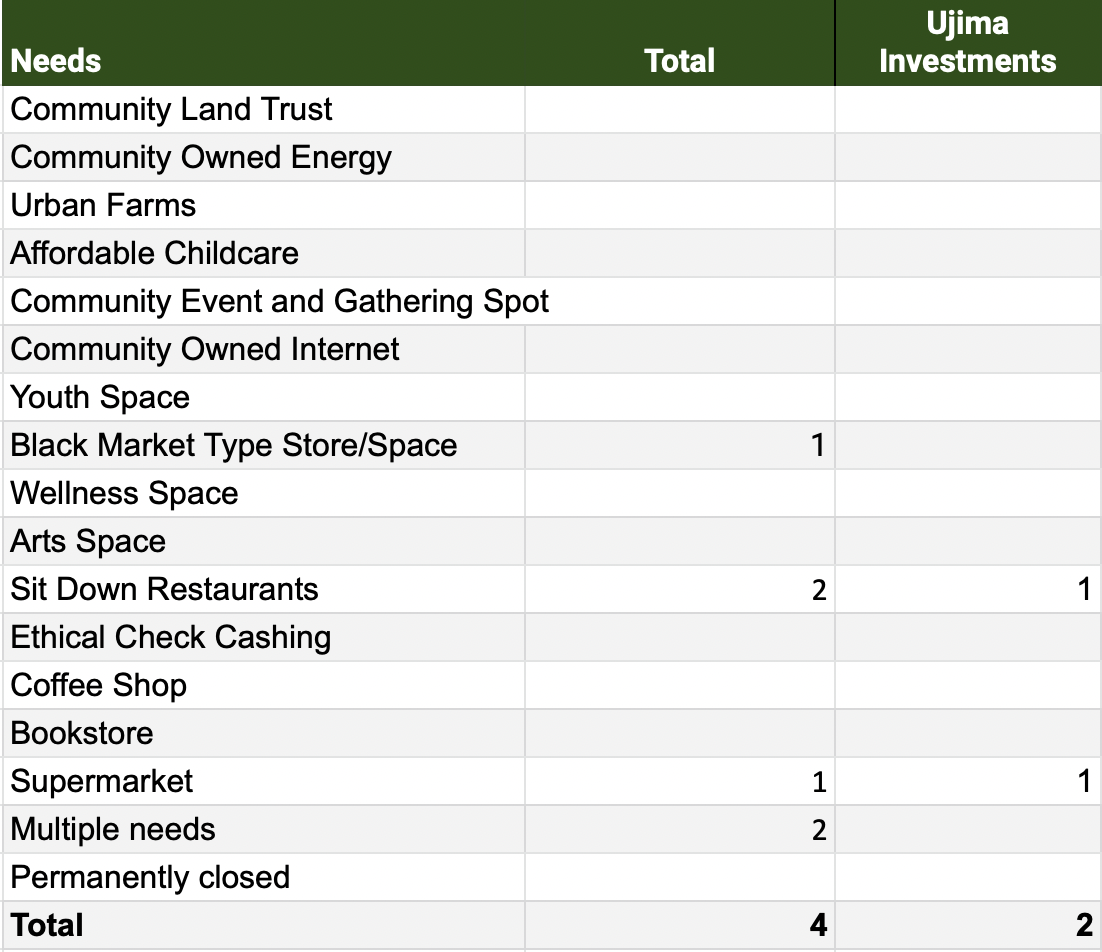

UGBA x Community Needs

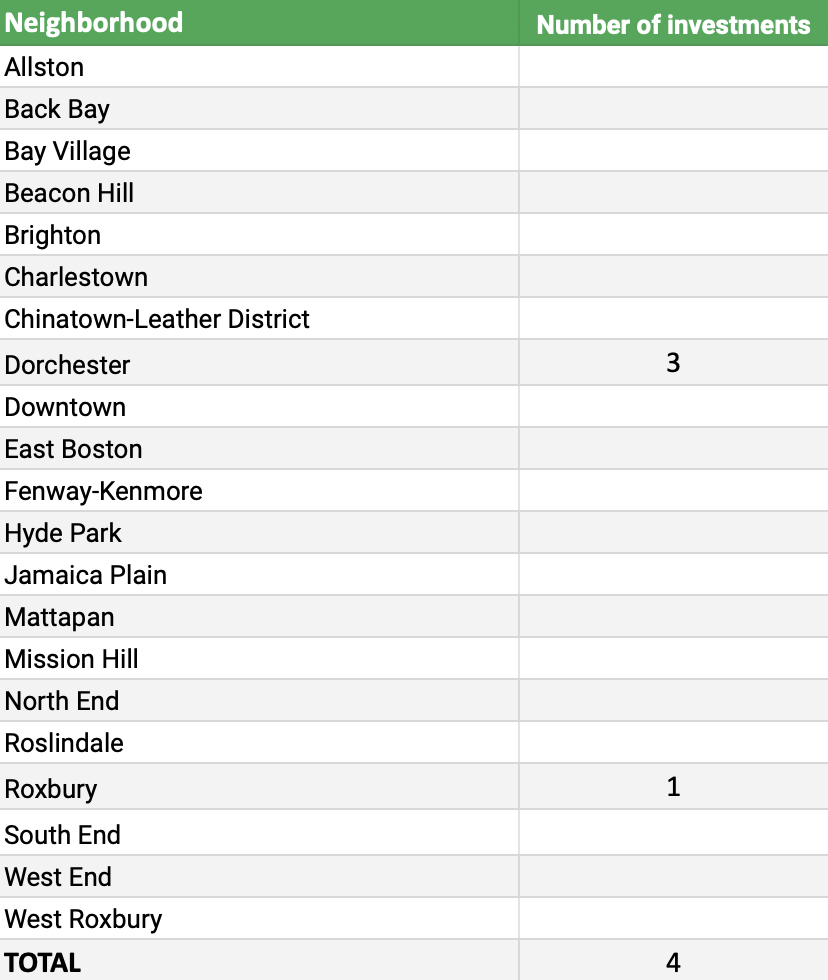

UGBA x Neighborhood

Current UGBA Support Needs

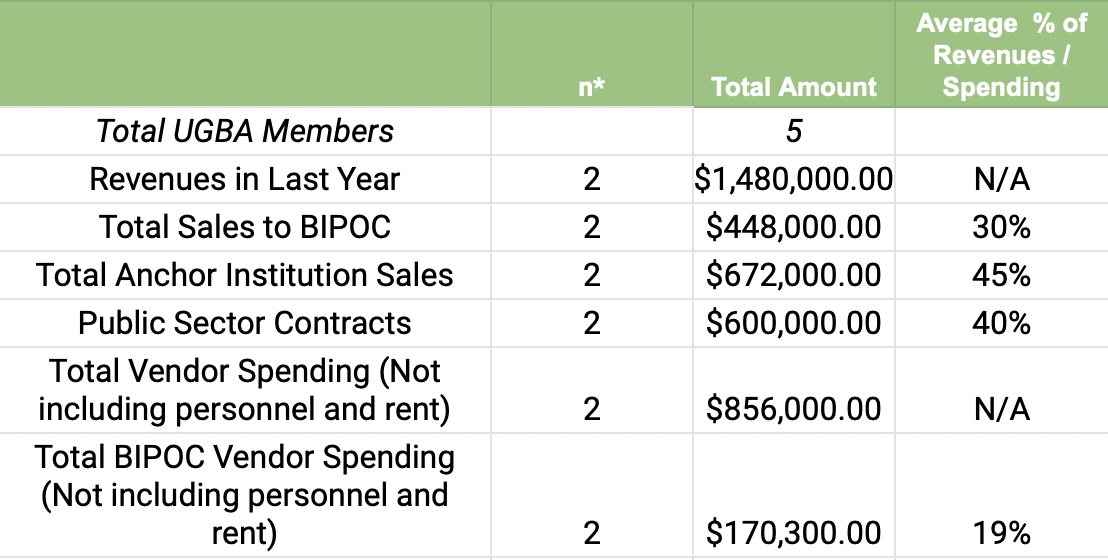

UGBA Customers and Vendors

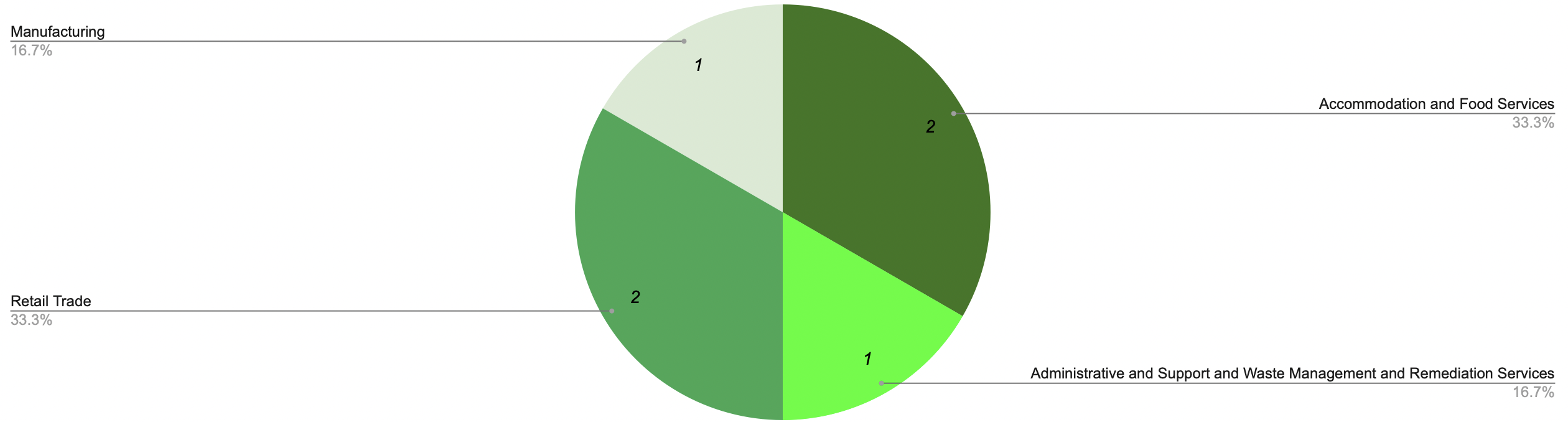

UGBA Members by Sector

UGBA Certifications

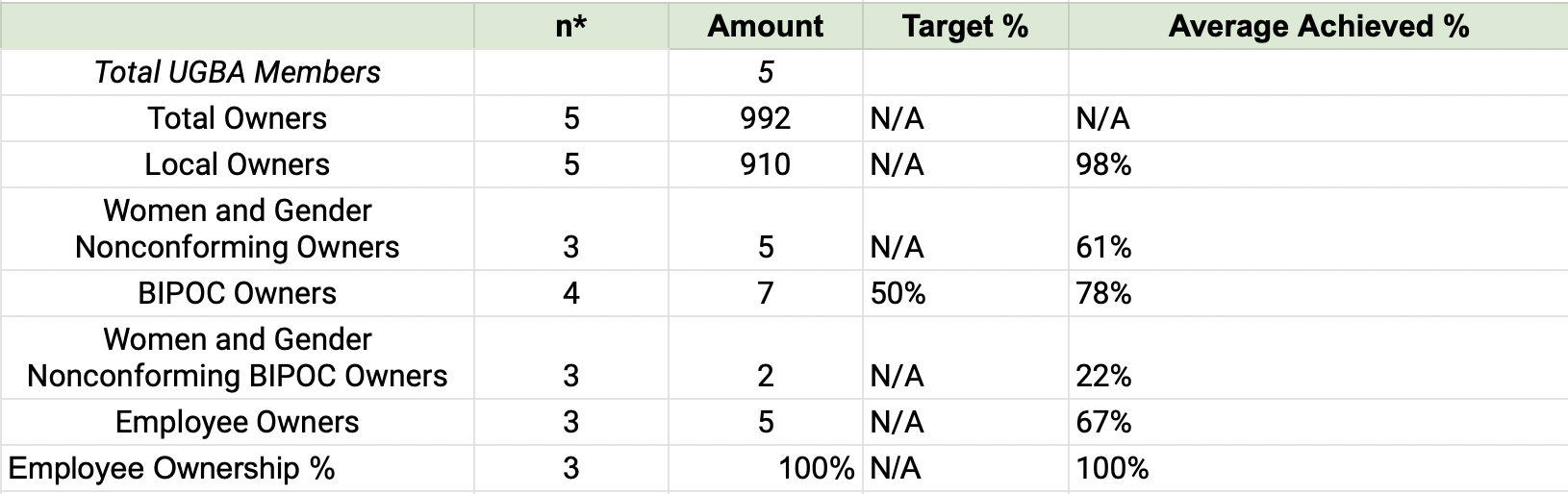

UGBA x Community Ownership

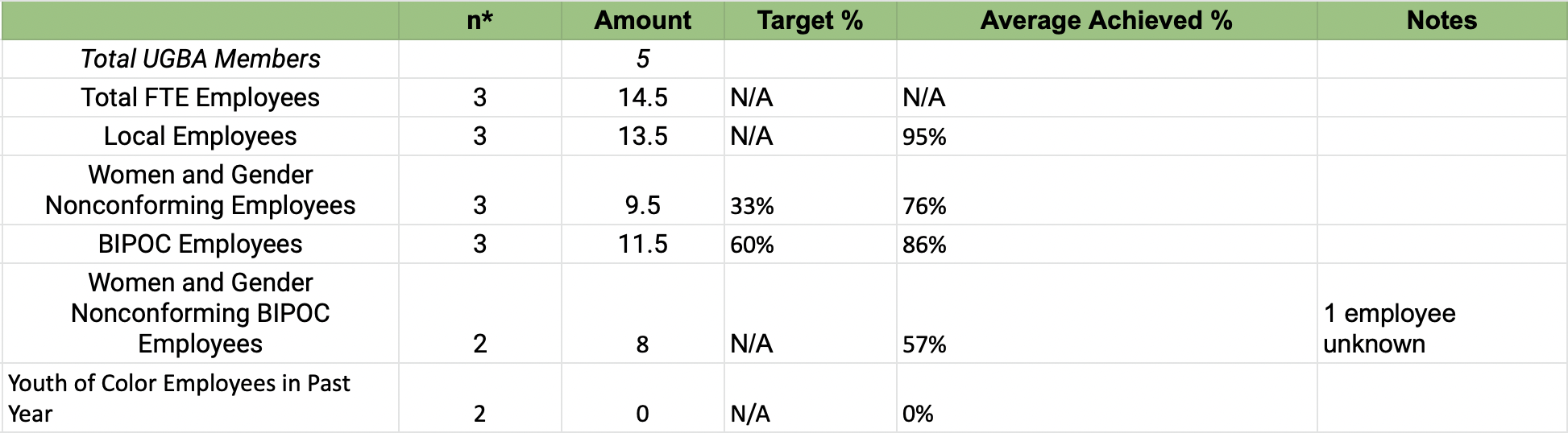

UGBA Workers

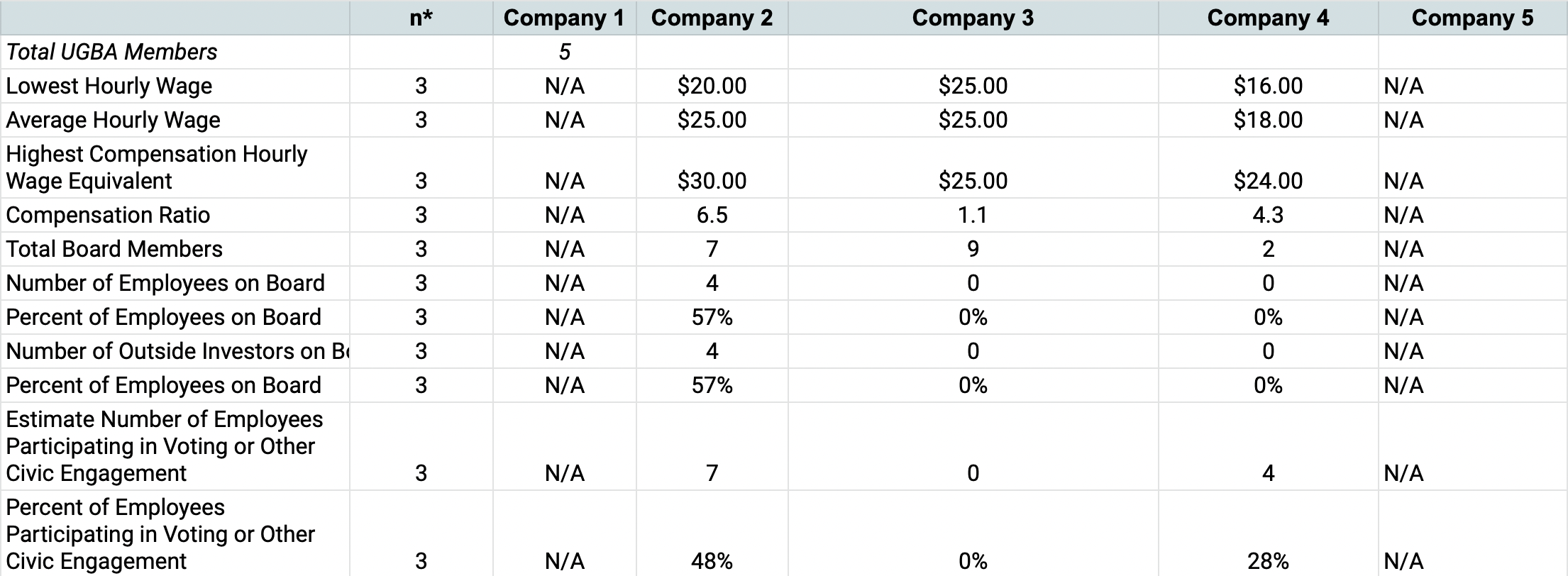

UGBA Good Jobs and Worker Power

UGBA x Health, Safety and Environment

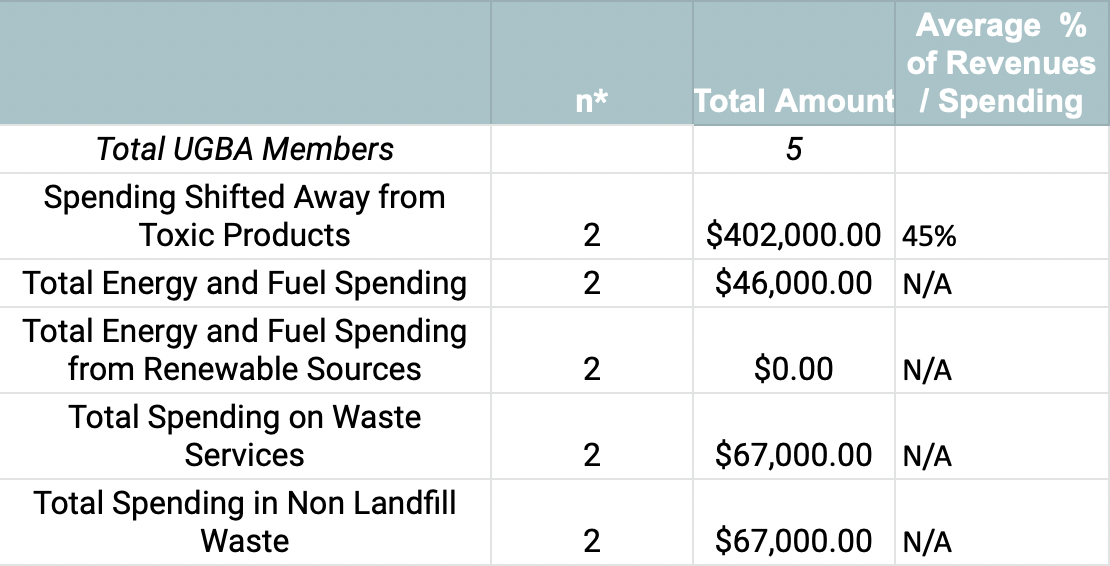

UGBA x Environment and Community Power