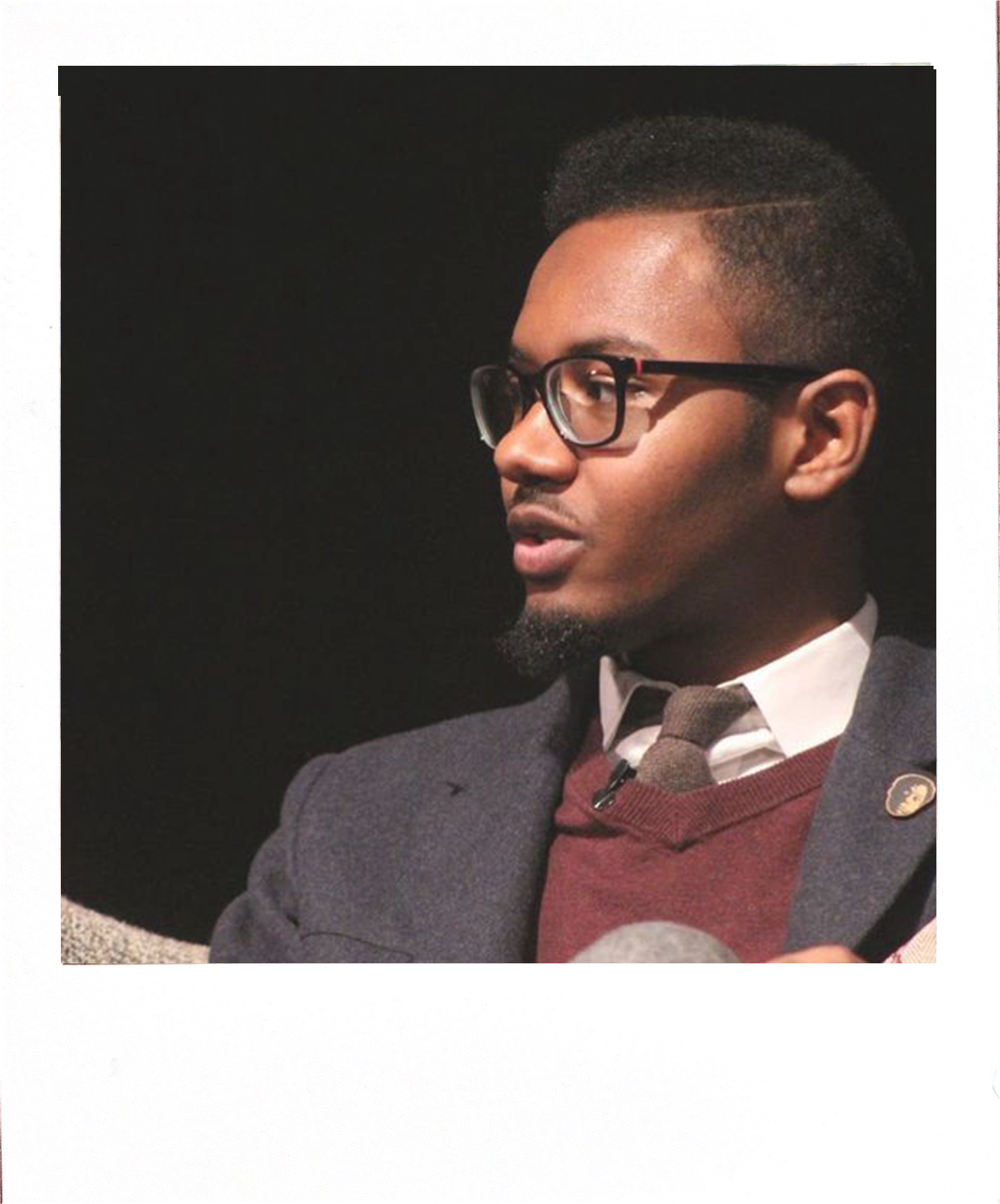

CHARLES

WALLACE-THOMAS IV

Photo courtesy of Charles Wallace-Thomas IV.

Charles Wallace-Thomas IV is originally from Ohio, but relocated to Boston and graduated from Northeastern University with a B.A. in Economics.

He’s committed to accelerating societal transitions rooted in sustainable agency and self-determination in marginalized communities through collective decision making.

In 2020, Charles became a co-founder and Editor of The Second and Fourth Review, a publication confronting questions concerning the state and future of the racialized and class-stratified human condition.

Tell us about yourself.

I’m Charles Wallace IV, and I’m a native of Columbus, Ohio, but a transplant to Boston. I came here for school, to attend Northeastern University where I studied economics. I spent some time working at Ujima as a part of the Co-op program in 2019, and I had been a volunteer for a while there. I also had the chance to work at the Center for Economic Democracy and the Participatory Budgeting Project, as well. So this idea of new economies and new ways of organizing economic activity really fascinates me.

How did you first hear about Ujima?

Yeah, I first heard about Ujima from someone who had become a mentor to me at Northeastern [and] was an organizer for Students Against Institutional Discrimination. At the time, I had just come out of being bifurcated between philanthropy and organizing, so I was trying to figure out how to advocate for political, economic, and social justice, all at the same time.

So I learned about Ujima and attended their Black Trust lecture with Phil Thompson, who talked about race and money being the same thing. It was really cool, and I had an epiphany about how Ujima was operating at the intersection of those three axes I identified as important for my own life's journey. That was my first introduction to Ujima.

Are you an avid investor?

Well, I'm very enthusiastically invested in Ujima. I don't have very many other personal investments, so I wouldn't say that I'm an avid investor in the monetary sense. But I'm an avid investor in the creation of these different experiments that allow us to figure out the best ways of organizing ourselves moving forward.

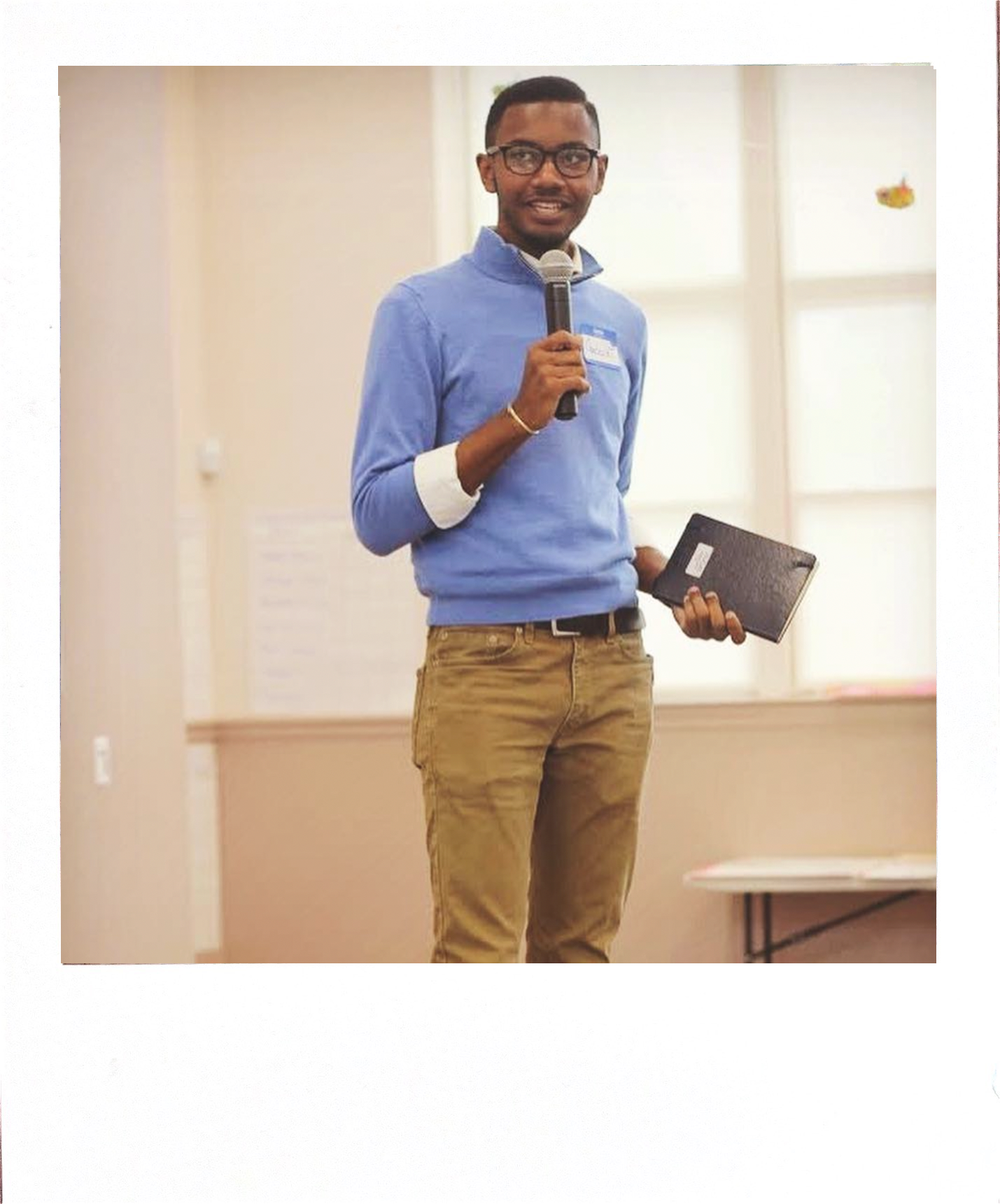

“Investing was a way that I could ‘put my money where my mouth is,’ and see to what extent this theory of change translated into a practice. [It] was [a] way to signal that Ujima’s model could work, and a way to signal to others that I had a stake in the success of this work.”

Charles at Ujima presentation, 2018.

How did the spaces you grew up in, public or private, impact your approach to investing?

Growing up in Ohio, in Columbus, specifically, it was very clear that there were two different cities. One for folks who had capital and those who didn’t. So I was very conscious of the fact that investment could be both a tool for growth and security and cultural and political destruction.

So in high school, I lived in a community called Old Town East, which was historically this really wealthy suburb around the 19th century, then it became a neighborhood where Black folks were concentrated in. By the time I left high school, the property values had risen, such that we had been pushed further and further out of the community. There was this wanton disregard for what was being destroyed in the service of higher rent prices and sale prices for houses.

I was very conscious of the fact that there was an immense amount of power in organized economic activity. This has always been something that I had not necessarily been a victim of, but not a beneficiary of either. That's why Ujima was so exciting because it not only allowed for the kind of analysis that would make these racial and class dynamics clear at the structural level but also allow people to articulate their own experiences. Ujima gets people excited about what it is we're doing to mitigate these issues, move forward, and build something together.

What are you looking for in your investments? How do you decide what to invest in?

I think one of the primary things that I look for is socio-political analysis, right? So having been educated in a very conventional, neoliberal economic context, the things that we're taught to look for are things that don't necessarily have a lot of bearing in the real world as it applies to me. So things like prioritizing the financial health of a business, its ability to occupy as much market share value as possible, or being as ruthless in the way profit margins are constructed.

What I am looking for is folks who pay attention to financial details and [the] viability of whatever projects that we're engaging in. So noticing how much attention they’re paying to the way that power is structured in investments, the way investment is returned, and how businesses are operating. Are they paying attention to the way that enterprises or organizations are affecting the communities that they're in? And to what extent are they invested in sustainable futurity?

Why was it important for you to invest in the Ujima Fund?

Investing was a way that I could “put my money where my mouth is,” and effectively see to what extent this theory of change translated into a practice. Some folks give a lot of time to Ujima as volunteers, but at the time I joined Ujima, we were really trying to get folks invested in the Fund. So investing was another way to signal to myself that Ujima’s model could work, and a way to signal to others that I had a stake in the success of this work.

What does being a young, Black investor mean to you?

Investing in Ujima was meaningful because I’m also investing in a type of Blackness that moves beyond traditional narratives of “Black excellence.” Attending a predominantly White university, where a lot of folks are coming from middle and upper-middle-class backgrounds, Black excellence means you must excel academically, and become a conventional professional, doctor, lawyer, engineer, pharmacist, etc.

It was very difficult to assert the fullness of my Black identity in that space, while also not diminishing the significance of other Black folks’ accomplishments. So for me, Ujima represents a very Black endeavor that is very attuned to generational wealth and increasing political power without perpetuating the imbalances that we see in Black excellence culture.

In what ways has the pandemic inspired you to question your investment practice? Have the past two years revealed any changes you want to live, work and invest?

Changes to my thinking happened in phases. The pandemic gave me the opportunity to stop, reflect, and go deeper [into] the political analysis that undergirds the personal investment strategies I have. So I did a lot of reading and attended workshops and webinars on how to align my theory of change with different investment practices.

On a personal finance level, I started a little retirement account and wonder[ed] what I should invest in within traditional stocks that aren’t at odds with my own belief system. But over time, it became clear to me that individually investing in things like wind energy, for instance, is not enough; we need community-owned energy infrastructures. We need collective strategies for investment. So, the pandemic made me much more attuned to the urgency of experimenting with different forms of organizing ourselves with.

What are you most looking forward to when it comes to the future?

It’s really nice not to be in classes anymore! I’ll be going on a writing retreat at the end of this month with some friends. So I'm looking forward to writing my ideas down more. There’s a publication I founded called the Second and Fourth Review, for which I received an Ujima Ashe Ashe grant that I'm really excited about. So I'm looking forward to continuing to do that interrogation and have those structural conversations through this publication.

Very soon, I'll be entering the professional world ahead of graduate school further down the line. I'm very excited to be able to challenge myself or be part of a team that works on practical solutions for deep problems. I’m also really happy about the Jazz Urbane [Cafe] investment. I'm really hopeful about what they can accomplish culturally and economically in that space. ◼︎