COREY ALLEN

Corey J. Allen, born and raised in Mattapan, is a proud investor in the Ujima Fund.

An educator and journalist by trade, and an active citizen by choice, Allen works and volunteers in and around Boston investing in the community he loves.

A graduate of Boston Latin Academy and a double graduate of UMass Boston (B.A. in English Language Arts, Minor in African-American Studies and M. Ed in English Language Arts Instruction), Allen is a strong believer in public institutions for education and business development. In his spare time, Allen serves on the Governing Board of TechBoston Academy (Dorchester), Mattapan Family Service Center Advisory Board, gardening, playing chess and spending time with his family.

An educator and journalist by trade, and an active citizen by choice, Allen works and volunteers in and around Boston investing in the community he loves.

A graduate of Boston Latin Academy and a double graduate of UMass Boston (B.A. in English Language Arts, Minor in African-American Studies and M. Ed in English Language Arts Instruction), Allen is a strong believer in public institutions for education and business development. In his spare time, Allen serves on the Governing Board of TechBoston Academy (Dorchester), Mattapan Family Service Center Advisory Board, gardening, playing chess and spending time with his family.

Tell us about yourself.

I am an active citizen, educator, and journalist from Mattapan. And I want to see Boston a little better by the time I leave this place. And I do my best through my work, volunteering, and investment to make that happen.

Are you an avid investor?

I don't know if I'm an investor, [but] I would say that I try to be [a] conscious investor. So I've invested in real estate. I have multifamily property. Stocks, I own some safety bonds, or, I guess stable bonds if you will. You know, I have a diversified portfolio. I have some real estate investment trusts that I invest in, and then Ujima Fund.

What are you looking for in your investments? How do you decide what to invest in?

I like to invest in a way that creates some capital that I can leave my family when I pass away. When it comes to investment, legacy is very important to me, as well as the social aspect of what I'm investing in. With real estate it's pretty straightforward, right? You invest, and you get returns from [the] appreciation of the property from having rental tenants and any developments around the property that increase the value.

In terms of my stocks, I like to think about companies I have faith in or work on issues that I care about. Particularly for the Ujima Fund, the fact that my contribution will go towards helping individuals from my community that are building their businesses means a lot. That’s a big reason why I decided to invest in the Ujima Fund.

“I learned early on that sometimes the best investment you can make is in people. [...] The Ujima Fund isn’t just a good return on investment, but it also supports the wealth of Boston’s communities of color.”

What does being a young, Black investor mean to you?

My father worked in finance for over twenty years. We used to vacation on Cape Cod, and I remember him watching the news for stock updates. Back in those days, he had to find a payphone to call and execute his trades. So I grew up watching him and eventually started investing through an ETrade account.

It’s been a while since I thought of myself as young, but with the time I have left in my life, I want to leave something behind for my family. I also learned early on that sometimes the best investment you can make is in people. When you have a leader like Nia K. Evans, who has a great track record and reputation, you know that whatever she believes in is going to be a solid investment. The Ujima Fund isn’t just a good return on investment, but it also supports the wealth of Boston’s communities of color.

After the 2020 uprisings, there was a lot of talk about investing in the Black community and Black entrepreneurs. From where you sit, are companies following through on their pledges to invest?

Like anything else, you’ll always have some individuals that are more or less sincere in the pledges they made in the last couple of years. We saw some companies go back to business as usual when racial equity was no longer a hot topic. Ujima is a great antidote to this because the fund is able to invest in businesses by entrepreneurs of color, but also encourage larger institutions to make similar investments. We have to hold companies accountable [for] their commitments. I look forward to seeing the growth of companies that the Ujima Fund invested in.

What would you want to see happen in the future when it comes to broader investments in entrepreneurs of color?

I want to see us go back in time. There used to be well-organized Black ecosystems that didn’t allow the dollar to leave the Black community. There were movie theaters and restaurants owned by Black folks, and these businesses supported each other. Although I do invest in some large firms, I like investing in Black-owned companies as well. And I hope that we go back to that sentiment of Black ownership. We’ve really lost the ability for us to keep dollars in our own community and build that communal wealth. I hope we return to that.

What are you most looking forward to when it comes to the future?

I look forward to seeing my nieces and nephews accomplish all their dreams; whether it’s becoming doctors, athletes, and such. I also look forward to continued good health and making sound investments. Someone once said, “the more you make, the more you give.” So I look forward to continuing to make good strategic investments that create enough income for me to invest in good ventures. When my nieces and nephews reflect on my time, I hope they can say I made a positive impact on their lives, through my writing, investing, or civic activism. I want to leave this world better than I found it.

Any final reflections?

As individuals, we can certainly do good things, but as a collective, we can do more. So I would encourage folks to heed Ujima’s calls for support, whether it’s public banking advocacy, individual donations, or just spreading the good word about what's going on – put actions behind your words.

CHARLES

WALLACE-THOMAS IV

Photo courtesy of Charles Wallace-Thomas IV.

Charles Wallace-Thomas IV is originally from Ohio, but relocated to Boston and graduated from Northeastern University with a B.A. in Economics.

He’s committed to accelerating societal transitions rooted in sustainable agency and self-determination in marginalized communities through collective decision making.

In 2020, Charles became a co-founder and Editor of The Second and Fourth Review, a publication confronting questions concerning the state and future of the racialized and class-stratified human condition.

Tell us about yourself.

I’m Charles Wallace IV, and I’m a native of Columbus, Ohio, but a transplant to Boston. I came here for school, to attend Northeastern University where I studied economics. I spent some time working at Ujima as a part of the Co-op program in 2019, and I had been a volunteer for a while there. I also had the chance to work at the Center for Economic Democracy and the Participatory Budgeting Project, as well. So this idea of new economies and new ways of organizing economic activity really fascinates me.

How did you first hear about Ujima?

Yeah, I first heard about Ujima from someone who had become a mentor to me at Northeastern [and] was an organizer for Students Against Institutional Discrimination. At the time, I had just come out of being bifurcated between philanthropy and organizing, so I was trying to figure out how to advocate for political, economic, and social justice, all at the same time.

So I learned about Ujima and attended their Black Trust lecture with Phil Thompson, who talked about race and money being the same thing. It was really cool, and I had an epiphany about how Ujima was operating at the intersection of those three axes I identified as important for my own life's journey. That was my first introduction to Ujima.

Are you an avid investor?

Well, I'm very enthusiastically invested in Ujima. I don't have very many other personal investments, so I wouldn't say that I'm an avid investor in the monetary sense. But I'm an avid investor in the creation of these different experiments that allow us to figure out the best ways of organizing ourselves moving forward.

“Investing was a way that I could ‘put my money where my mouth is,’ and see to what extent this theory of change translated into a practice. [It] was [a] way to signal that Ujima’s model could work, and a way to signal to others that I had a stake in the success of this work.”

Charles at Ujima presentation, 2018.

How did the spaces you grew up in, public or private, impact your approach to investing?

Growing up in Ohio, in Columbus, specifically, it was very clear that there were two different cities. One for folks who had capital and those who didn’t. So I was very conscious of the fact that investment could be both a tool for growth and security and cultural and political destruction.

So in high school, I lived in a community called Old Town East, which was historically this really wealthy suburb around the 19th century, then it became a neighborhood where Black folks were concentrated in. By the time I left high school, the property values had risen, such that we had been pushed further and further out of the community. There was this wanton disregard for what was being destroyed in the service of higher rent prices and sale prices for houses.

I was very conscious of the fact that there was an immense amount of power in organized economic activity. This has always been something that I had not necessarily been a victim of, but not a beneficiary of either. That's why Ujima was so exciting because it not only allowed for the kind of analysis that would make these racial and class dynamics clear at the structural level but also allow people to articulate their own experiences. Ujima gets people excited about what it is we're doing to mitigate these issues, move forward, and build something together.

What are you looking for in your investments? How do you decide what to invest in?

I think one of the primary things that I look for is socio-political analysis, right? So having been educated in a very conventional, neoliberal economic context, the things that we're taught to look for are things that don't necessarily have a lot of bearing in the real world as it applies to me. So things like prioritizing the financial health of a business, its ability to occupy as much market share value as possible, or being as ruthless in the way profit margins are constructed.

What I am looking for is folks who pay attention to financial details and [the] viability of whatever projects that we're engaging in. So noticing how much attention they’re paying to the way that power is structured in investments, the way investment is returned, and how businesses are operating. Are they paying attention to the way that enterprises or organizations are affecting the communities that they're in? And to what extent are they invested in sustainable futurity?

Why was it important for you to invest in the Ujima Fund?

Investing was a way that I could “put my money where my mouth is,” and effectively see to what extent this theory of change translated into a practice. Some folks give a lot of time to Ujima as volunteers, but at the time I joined Ujima, we were really trying to get folks invested in the Fund. So investing was another way to signal to myself that Ujima’s model could work, and a way to signal to others that I had a stake in the success of this work.

What does being a young, Black investor mean to you?

Investing in Ujima was meaningful because I’m also investing in a type of Blackness that moves beyond traditional narratives of “Black excellence.” Attending a predominantly White university, where a lot of folks are coming from middle and upper-middle-class backgrounds, Black excellence means you must excel academically, and become a conventional professional, doctor, lawyer, engineer, pharmacist, etc.

It was very difficult to assert the fullness of my Black identity in that space, while also not diminishing the significance of other Black folks’ accomplishments. So for me, Ujima represents a very Black endeavor that is very attuned to generational wealth and increasing political power without perpetuating the imbalances that we see in Black excellence culture.

In what ways has the pandemic inspired you to question your investment practice? Have the past two years revealed any changes you want to live, work and invest?

Changes to my thinking happened in phases. The pandemic gave me the opportunity to stop, reflect, and go deeper [into] the political analysis that undergirds the personal investment strategies I have. So I did a lot of reading and attended workshops and webinars on how to align my theory of change with different investment practices.

On a personal finance level, I started a little retirement account and wonder[ed] what I should invest in within traditional stocks that aren’t at odds with my own belief system. But over time, it became clear to me that individually investing in things like wind energy, for instance, is not enough; we need community-owned energy infrastructures. We need collective strategies for investment. So, the pandemic made me much more attuned to the urgency of experimenting with different forms of organizing ourselves with.

What are you most looking forward to when it comes to the future?

It’s really nice not to be in classes anymore! I’ll be going on a writing retreat at the end of this month with some friends. So I'm looking forward to writing my ideas down more. There’s a publication I founded called the Second and Fourth Review, for which I received an Ujima Ashe Ashe grant that I'm really excited about. So I'm looking forward to continuing to do that interrogation and have those structural conversations through this publication.

Very soon, I'll be entering the professional world ahead of graduate school further down the line. I'm very excited to be able to challenge myself or be part of a team that works on practical solutions for deep problems. I’m also really happy about the Jazz Urbane [Cafe] investment. I'm really hopeful about what they can accomplish culturally and economically in that space. ◼︎

JEFF SIMILIEN

Jeff Similien is the founder and CEO of Boston Trust Realty Group Commercial (BTRG), LLC, located in the heart of Mattapan Square, and has brokered several transactions with major franchises such as Papa John’s and Frugal Furniture, amongst others. However, Jeff’s focus and true passion has always been working with small business owners and guiding them through the often biased commercial real estate industry. Similien received a degree in Business Management from Curry College. In addition to real estate, Jeff is passionate about developing his community. He recently founded The Co-Pad, a collaborative co-working hub for entrepreneurs in the Mattapan, Dorchester and Hyde Park area. More recently, Jeff became the CEO and founder of Lowkey Dispensary, a black owned marijuana dispensary in Dorchester.

Tell us about yourself.

Well, my name is Jeff Similien. I’m a commercial real estate broker in Boston, Massachusetts. I have an office in Mattapan. I also own a marijuana dispensary that’s set to open later this year in Dorchester. I’m in line to open up a cultivation center in Hyde Park, and possibly a second location in West Roxbury. In addition, I founded a nonprofit called Kings Amongst Kings, where I help mentor young black men in the community. We meet once a month in Mattapan [to] talk and share stories to help each other grow.

How did you first hear about Ujima?

I first heard about Ujima from my business coach who mentioned a meeting that I believe Ujima was having in Roxbury. I attended that first meeting, where we talked about community investment opportunities. So I wanted to take advantage of what Ujima had to offer.

Are you an avid investor? Why was it important for you to invest in the Ujima Fund?

So I’ve been investing in real estate since 2006. I do invest in stocks and other commodities, but Ujima was one of the few investments that, to me, was about being black-owned. And, it was community-driven. So I definitely want to be part of that movement around community power and investment. So that was the biggest reason that I was willing to invest in Ujima.

What does being a young, Black investor mean to you?

I mean, just Black history and where we come from and not having opportunities as simple as being able to read and live independent lives, we’ve really come a long way. So when we talk about investing and ownership, I know it’s a privilege to be in this position. All that I’ve accomplished through my businesses and investments means a lot.

In what ways has the pandemic inspired you to question your investment practice? Have the past two years revealed any changes you want to live, work and invest?

One of the things that real estate has definitely taught me was to really slow down, analyze, and process things. I learn that just because an investment looks good now, it may not last forever. You really have to evaluate things based on what is sustainable in the long term, not based on its potential. So that’s something new I picked up from all of the volatility I saw in the pandemic.

“[W]hen we talk about investing and ownership, I know it’s a privilege to be in this position.

All that I’ve accomplished through my businesses and investments means a lot.”

After the 2020 uprisings, there was a lot of talk about investing in the Black community and Black entrepreneurs. From where you sit, are companies following through on their pledges to invest?

I mean there are definitely institutions making such commitments to gain popularity, so people just have to be careful about who they do business with and where they put their money. It’s ultimately about holding companies and people accountable. We should learn not to get easily baited by large dollar amounts when companies make pledges to certain causes. Because they can easily backtrack on these commitments. We just have to pay attention to keywords, so we don’t get bamboozled.

What are you most looking forward to when it comes to the future?

On a personal level, I'm a new father. So I want to be able to watch my kids grow and change over time. With my nonprofit organization, one of the things that I realized was that as men and Black people— we all go through a lot of trauma. Whether it’s about family, work, etcetera, a lot of us carry that trauma, and it’s a heavy burden on our backs. So I want us to understand that we don't have to carry that on our backs every day; we can put that load down, be free, and move forward. So I just want to see more Black people seek therapy and talk openly about their experiences.

Any final reflections?

I just came from Costa Rica, and it’s one of the most beautiful places ever. So I wanted to leave you with this saying I picked up from Costa Rica: pura vida. It’s a reminder to try and enjoy life no matter the circumstances. We’re living through a tough time in our nation’s history, so there are bad things going on everywhere in the world, but there are amazing and beautiful things as well. ◼︎

ALUA AUMADE

Photo courtesy of Alua Aumade.

Alua Aumade is from Texas and has put down roots in New England. He works in healthcare finance and is interested in ethical real estate investing. He likes creating unique experiences by bringing people together over food and the outdoors.

Tell us about yourself.

I’m originally from Texas, and I work in healthcare finance. More broadly I’m really interested in bringing people together through unique experiences. For instance, I’d love to host a dinner for my friends in the middle of the desert. Whenever you go to some of the national parks out west, you don't see a lot of Black people, unfortunately, in these amazing spaces. I love food and cooking creatively, so this is something I’ve done in bits and pieces, but I'm trying to put it all together.

Tell us about yourself.

I’m originally from Texas, and I work in healthcare finance. More broadly I’m really interested in bringing people together through unique experiences. For instance, I’d love to host a dinner for my friends in the middle of the desert. Whenever you go to some of the national parks out west, you don't see a lot of Black people, unfortunately, in these amazing spaces. I love food and cooking creatively, so this is something I’ve done in bits and pieces, but I'm trying to put it all together.

How did you first hear about Ujima?

I first heard about Ujima from Nia K. Evans around 2018. She told me about the importance of community-oriented investing, which I love. So I was 100% down to learn more and get involved.

Are you an avid investor?

I’ve dabbled in stocks and cryptocurrency a little bit, but real estate investing is where most of my interest lies. So I bought a multifamily property two years ago and I'm looking to buy a second property this year. Honestly, I'm really trying to get out of the rat race through real estate investing, but I’m also trying to make sure that I’m contributing to solutions for the housing crisis, rather than making it worse.

Why was it important for you to invest in the Ujima Fund?

At the time, I actually didn’t know of other meaningful ways to get involved, besides investing. I invested because I believe in Ujima’s mission, but [I] didn’t know of other options that made sense for me at the time.

What does being a young, Black investor mean to you?

Being a young, Black investor means paying attention to a long-term strategy that contributes to Black wealth. So even though the Ujima Fund isn’t my only investment, it’s important for me to participate in political experiments like this.

In what ways has the pandemic inspired you to question your investment practice? Have the past two years revealed any changes you want to live, work and invest?

In terms of real estate investing, I heard rent increased 15% over the last year. I think it kind of dipped slightly last year, or maybe 2020, just because that was a pandemic. But still, learning this was alarming.

My multifamily property has tenants. It's really important for me to keep my rent under market rate, so I can support the family that lives there. Because I kept the rent affordable, this family is now able to buy a house of their own.

While other property owners might be annoyed by them moving out, to me it’s phenomenal. I have other opportunities to make money in real estate investing, but fewer opportunities to create affordable housing. This is something I’ve become acutely aware of since the pandemic.

After the 2020 uprisings, there was a lot of talk about investing in the Black community and Black entrepreneurs. From where you sit, are companies following through on their pledges to invest?

I haven't looked at these commitments super closely, but I have a lot of friends that work in the D.E.I. (diversity, equity, inclusion) space who are closer to these issues. I know there’s much more awareness around how to operate businesses in a way that’s more welcoming to Black people, but some of it feels performative, so I don't put a whole lot of stock in these corporate attempts to be more equitable.

“Being a young, Black investor means paying attention to a long term strategy that contributes to Black wealth.

So even though the Ujima Fund isn’t my only investment, it’s important for me to participate in political experiments.”

So even though the Ujima Fund isn’t my only investment, it’s important for me to participate in political experiments.”

What would you want to see happen in the future?

I would love to see stronger commitments to resource Black committees and companies, beyond the token Black person serving as Chief Diversity Officer. Within companies, I think there needs to be more Black people in middle and upper-level management, and in other roles that are critical to business functions.

What are you most looking forward to when it comes to the future?

I'm really looking forward to getting out of the nine to five rat race. Once I do that, I think I’ll have more emotional energy [and] time to pursue some entrepreneurial endeavors, and experience some personal growth.

Any final reflections?

I really appreciate that Ujima is an organization that goes beyond the talk about what can be done for the Black community and actually puts resources into executing on solutions. ◼︎

BLACK MARKET NUBIAN

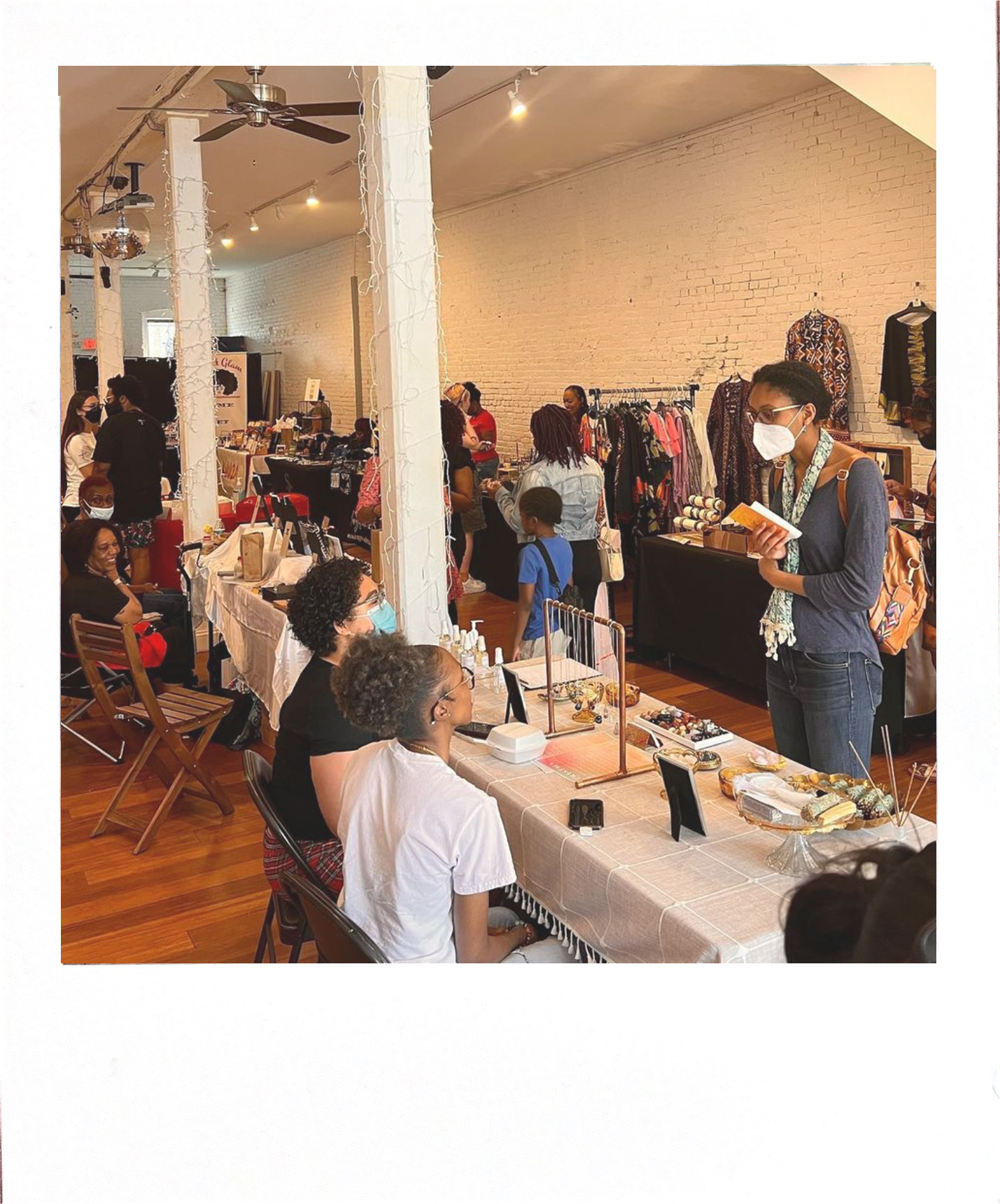

Photo courtesy of Black Market Nubian and Boston Globe.

Black Market was established in 2017 as a nascent pop-market with a vision to help close Boston’s wealth gap and mission to reignite Roxbury’s creative economy. The Marketplace was widely accepted as one of Boston’s premiere spaces to gather, meet and shop, understanding the need for micro-business founders to develop the business acumen and literacy needed to move towards sustainability.

Recently, Black Market Nubian was invited to join the Ujima Good Business Alliance. Following their acceptance into the Ujima Good Business Alliance, Paige Curtis, Culture & Communications Manager, caught up with Kai Grant, co-founder of Black Market, to learn more about their commitment to economic justice, arts & culture, and civic engagement.

Recently, Black Market Nubian was invited to join the Ujima Good Business Alliance. Following their acceptance into the Ujima Good Business Alliance, Paige Curtis, Culture & Communications Manager, caught up with Kai Grant, co-founder of Black Market, to learn more about their commitment to economic justice, arts & culture, and civic engagement.

Paige Curtis: Can you talk about the need for an endeavor like Black Market in Roxbury?

Kai Grant: We went into it with this question of how we could fill a need. We were very intentional. We happened to be creative entrepreneurs because both of us have some type of artistic lens that we move from. My husband, Chris [Grant], and his family come from builders. Then my side of the family comes from free people who came to Boston in 1856, years ago, via the Underground Railroad. So that’s where our spirit of activism comes from. So I really think Black Market is a launchpad.

Some people take root in it, you know, some of the artists and some of the makers and founders have used it to move their business forward. It definitely was built with the intention of providing a higher quality of life. So the importance of Black Market has to do with including the micro-business community in the equation, and not leaving artisans, makers, founders, artists, and activists behind but shining a light on them. We want to give them a platform that, you know, would assist in the development of a Black identity in Boston, Massachusetts, and New England.

What are your thoughts on joining the Ujima Good Business Alliance?

This alliance is very critical for us, because we’re not a traditional retailer. We reimagined what retail could look like within a district that is struggling in the city. We feel accountable to our community, and want to be in partnership with organizations that do the work. We knew Nia from the NAACP work that we were doing back in 2010, 2011, and 2012. So it comes back to relationships, it comes back to feeling as though Ujima and Black Market were in alignment. I grew up practicing the principles of Kwanzaa. I come from Afrocentric parents that were activists, so I understand the energy of Ujima’s collective work and responsibility. We get that, because we practice that. It was important for us to make sure that we support initiatives for the sake of our communities.

Widline Pyrame of Fusion Dolls and Kai Grant outside of Black Market.

Widline Pyrame of Fusion Dolls and Kai Grant outside of Black Market. Inside Black Market Nubian, courtesy of Black Market.

Inside Black Market Nubian, courtesy of Black Market.“We feel accountable to our community, and want to be in partnership with organizations that do the work. It comes back to relationships, it comes back to feeling as though Ujima and Black Market were in alignment. I grew up practicing the principles of Kwanzaa.”

What are you most excited about Ujima and the Good Business Alliance?

Definitely the investing component, because we know the struggle. That’s literally being the change that we want to see. We’re also very excited about the transformation of the public realm for the sake of shifting vibration. Putting money into the hands of artists that live here means something to us. We don’t see a lot of funding in this neck of the woods. And so to have Ujima building up community capacity so we can build together is critical.

Anything upcoming for Black Market that you’d like to share?

We’re working on a refreshed Black Lives Matter mural. Then this summer, the weekend of June 10th, we’re hosting our annual “Buy the Block” party in Nubian Square, featuring a private meet and greet with a special guest. Then in July, we’re hosting more Nubiana activations — so much magic happens here. We’ll have more events coming in the fall, and in the winter we’ll host our signature Holiday Marketplace. We’re always busy! ■

This interview has been edited and condensed for length and clarity.

Learn more about Black Market on their website.